Guardianship Authority

Presidency of the

Council of Ministers

Lebanon announced 55 new foreign projects and partnerships in 2018, most of which were targeted at the upcoming reconstruction and infrastructure development effort in Syria. Moreover, there was a growing interest in the ICT sector and in servicing the country’s nascent oil and gas industry.

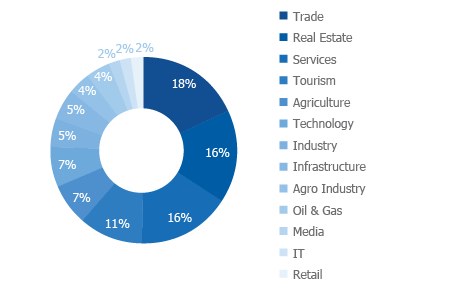

The Trade sector attracted the largest share of projects, powered by high rates of consumption and the continuous appeal of foreign products.

DISTRIBUTION OF FOREIGN COMPANIES IN LEBANON BY SECTOR (2018)

Source: Ministry of Economy and Trade, fDi Markets, Financial Times, IDAL

The Real Estate sector attracted the second largest share of projects. This was mainly due to the high appeal of Lebanon’s quality of life, focus on infrastructure development as well as projects targeted towards the reconstruction efforts in Syria.

The ICT sector witnessed interest from Arab investors in developing tech solutions for the region, leveraging Lebanon’s strong creative and marketing talent.

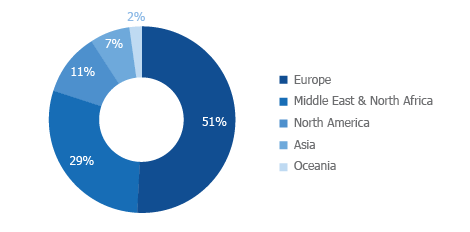

Europe accounted for 51% of foreign companies in Lebanon, holding the largest share in 2018. French investments ranked at the top (22% of total European investments), followed by Germany (13%), the United Kingdom (9%) and the Netherlands (9%). European projects were concentrated in the agro-food, oil and gas and trade sectors.

Middle East and North African countries followed with 29% of foreign investments in Lebanon. The UAE took the lead (32%), followed by Jordan, Egypt, Qatar, Algeria and Saudi Arabia (11% each). Investments by MENA countries were concentrated in technology, real estate and trade development projects.

The remaining 20% originated from North America, most notably the US (83%) and Canada (17%), followed by Asia (7%) and Oceania (2%).

DISTRIBUTION OF FOREIGN COMPANIES IN LEBANON BY COUNTRY OF ORIGIN (% Share|2018)

Source: Ministry of Economy and Trade, fDi Markets, Financial Times, IDAL

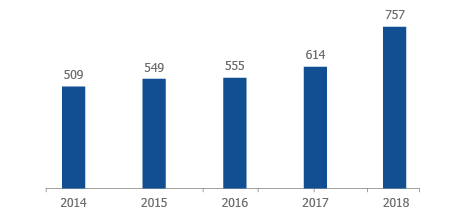

In a further boost to the economy, foreign investors took advantage of lower real estate prices, following the Central Bank of Lebanon’s decision to suspend housing subsidies, which led to an oversupply of projects. According to the General Directorate of Land Registry and Cadastre, the value of real estate transactions by foreigners increased by 23% year-on-year reaching USD 757 million in 2018.

EVOLUTION OF REAL ESTATE ACQUISITIONS BY FOREIGNERS IN LEBANON (USD Million)

Source: General Directorate of Real Estate, IDAL

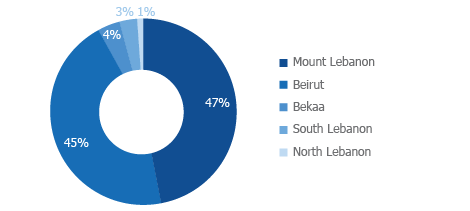

Mount Lebanon was the preferred location to foreign investors, accounting for 47% of total real estate acquisitions by foreigners in Lebanon, followed closely by Beirut (45%).

DISTRIBUTION OF FOREIGN INVESTMENTS IN THE REAL ESTATE SECTOR IN LEBANON BY GOVERNORATE (% Share|2018)

Source: General Directorate of Real Estate, IDAL

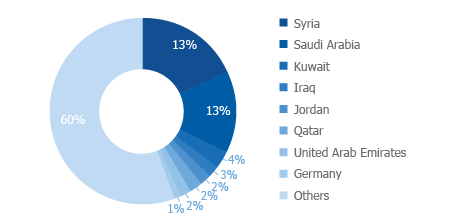

Syrians and Saudis remained as top foreign real estate investors, holding 13% each of total real estate acquisitions. While GCC nationals were consistent in their demand for real estate in Beirut, Syrians and other non-GCC Arabs opted primarily for Mount Lebanon.

DISTRIBUTION OF REAL ESTATE ACQUISITIONS IN LEBANON BY NATIONALITY (% Share|2018)

Source: General Directorate of Real Estate, IDAL