Guardianship Authority

Presidency of the

Council of Ministers

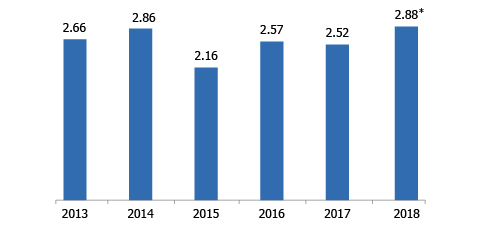

Foreign Direct Investment (FDI) flows to Lebanon jumped by 14% to USD 2.88 billion in 2018 compared to USD 2.52 billion in 2017, highlighting the continuous confidence of investors in the Lebanese economy.

FDI INFLOWS TO LEBANON (USD billion|2013-2018)

Note: According to the Central Bank of Lebanon, Foreign Direct Investment (FDI) was valued at USD 2.63 billion in 2018

Source: UNCTAD World Investment Report 2019

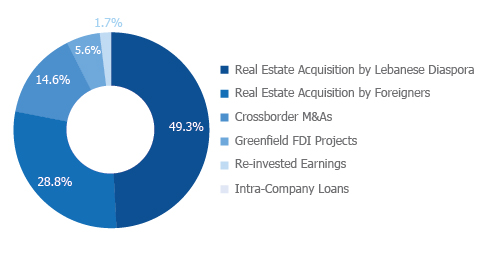

More than 70% of foreign investment flows came in form of real estate acquisitions, based on estimates from the Central Bank of Lebanon, the General Directorate of Real Estate, UNCTAD, the Financial Times and Moody’s. This was distributed between the Lebanese diaspora’s acquisition of real estate (49.3% of total acquisitions) and foreigners’ acquisitions (28.8% of total acquisitions). Meanwhile, cross-border mergers and acquisitions constituted 14.6% of total FDI with major acquisitions concentrated in the tourism and financial sectors (e.g. Saudi-based company Kingdom Holding sold its stake in the Four Seasons Hotel in Beirut for USD 120 million to a group of Lebanese and Arab investors). The remainder of FDI took the form of greenfield FDI projects (5.6%), re-invested earnings (1.7%) and intra-company loans (0.1%).

BREAKDOWN OF FDI BY TYPE OF INVESTMENTS IN LEBANON (% share|2018)

Note: These represent IDAL’s estimate for FDI distribution across economic sectors

Source: Central Bank of Lebanon, General Directorate of Real Estate, UNCTAD World Investment Report 2019, fDi Markets – The Financial Times, Moody’s, IDAL’s estimates

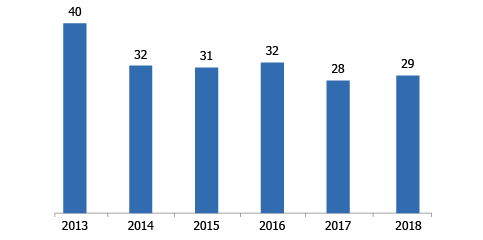

The increase of FDI to Lebanon was in line with FDI trends in the West Asia region, which Lebanon is a part of. FDI to West Asia grew by 3% to reach USD 29 billion in 2018, reversing an almost decade-long decline in FDI flows. Resource-seeking FDI played a major role in reversing the downward trend in the region.

FDI INFLOWS TO WEST ASIA REGION (USD billion|2013-2018)

Source: UNCTAD World Investment Report 2019

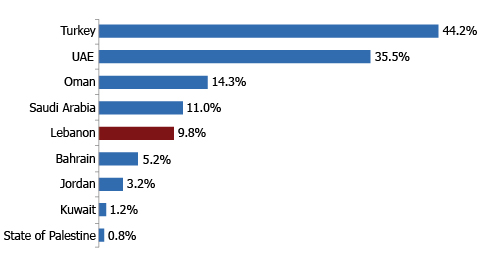

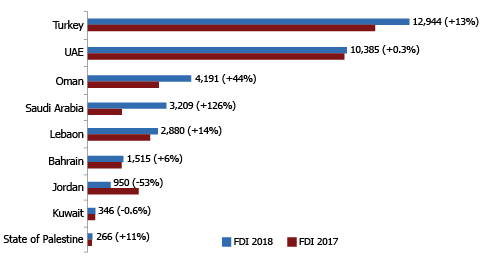

In terms of destination, Turkey and the United Arab Emirates accounted for the majority of inward FDI inflows to the region, while Lebanon was still among the top five FDI recipients in West Asia and ranked second among non-oil economies

FDI INFLOWS TO WEST ASIAN COUNTRIES AS A PERCENTAGE OF TOTAL INFLOWS (% share|2018)

Source: UNCTAD World Investment Report 2019

West Asian countries that experienced a significant increase in FDI included Saudi Arabia (+126%), Oman (+43%), Lebanon (+14%) and Turkey (13%). This was mainly due to the general easing of foreign investment regulations, diversification away from hydrocarbons and the renewed interest by US investors, as well as Chinese companies, looking to tap into the reconstruction of Syria.

COMPARATIVE VIEW OF FDI INFLOWS TO WEST ASIA REGION (USD million|2018)

Source: UNCTAD World Investment Report 2019

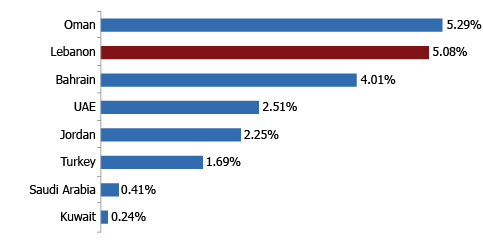

When calculating FDI inflows as a percentage of GDP, Lebanon stood out as the second-best performer in the region. FDI inflows to Lebanon accounted for 5% of GDP, making it the best performer among non-oil economies.

FDI INFLOWS TO WEST ASIA REGION AS A PERCENTAGE OF GDP (% share|2018)

Source: UNCTAD World Investment Report 2019